Dollar-IStockphoto

STRATEGIC ASSESSMENT. The key to unlocking the potential of the world’s largest archipelago is connecting more than 17,000 islands in Southeast Asia with an extensive network of airports, trains and toll roads.

That was the grand vision of Indonesian President Joko Widodo when he took office a decade ago, earmarking almost $800 billion for an infrastructure-building push that’s dwarfed the outlay of far bigger economies. But as Jokowi — as the president is more commonly known — finishes his final term in office, maturities are piling up, debt at state-run construction companies has jumped multifold and many projects are barely utilized.

Ahead of national elections next month, a sprawling airport on Indonesia’s largest island boasts an annual capacity that rivals Sydney’s Gateway — yet hosts only a few flights a week. Steep ticket prices threaten ridership of Southeast Asia’s first high-speed train, which is faster than the shinkansen but still far from full.

Sri Mulyani at a press conference held on Tuesday emphasized the strong growth of the United States economy in 2023 but pointed out that it was tempered by fiscal pressures, specifically the challenges associated with debt payments and the debt-to-GDP ratio of the U.S. government, which presents significant future risks. She also noted a deceleration in China’s economy attributed to the persisting property crisis.

Indonesia must be able to maintain increasing consumption and investment to support economic growth in 2024, Bank Indonesia (BI) Deputy Governor Aida S. Budiman stated here on Wednesday.

“According to our estimates, the composition of economic growth will come from domestic demand. That way, Indonesia must be able to maintain consumption and investment,” Budiman stated at the launch of the 2023 Indonesia Economic Report.

She remarked that Indonesia needs to sustain the upward trend of economic growth and synergy to maintain economic optimism, resilience, and revival in 2024.

The rupiah is projected to strengthen in the latter half of 2024, reaching its fundamental level of Rp 15,000. This aligns with Bank Indonesia’s anticipation of a reduction in the benchmark interest rate by the US Federal Reserve.

Merchants selling commodities at traditional markets have been taking part in developing Indonesia, serving as one of the foundations of the country’s national economy, Minister of Trade Zulkifli Hasan.

“Merchants operating in traditional markets have been the backbone of Indonesia and playing a decisive role in the country’s inflation rate. They are market merchants, not modern retailers,” Hasan remarked during a meeting with merchants of traditional markets in Solo, Central Java.

The minister noted that traditional market merchants and those running micro, small, and medium enterprises (MSMEs) had been helping Indonesia maintain a favourable rate of national inflation, noting that the rate stood at 2.61 per cent in 2023, a decline as compared to 5.5 per cent in the previous year.

The Ministry of National Development Planning/National Development Planning Agency (Bappenas) projected that Indonesia’s economy in 2024 would grow better than in 2023 despite the trend of slowdown in the global economy.

“Several international agencies have stated that Indonesia’s economy, amidst the ongoing global economic slowdown, is projected to grow stronger than in 2023,” the ministry’s Deputy of Economic Affairs, Amalia Adininggar Widyasanti, stated during the 2023 Indonesia Economic Report’s.

Institute for Economic and Social Research – Faculty of Economics and Business, University of Indonesia (LPEM FEB UI) has recently released Indonesia’s Q1 of 2024 economic outlook report, highlighting the country’s economic growth, titled ‘Transitional Year’.

A macroeconomy and financial market economist from LPEM FEB UI, Teuku Riefky, estimated that Indonesia’s GDP has grown over 5.02 – 5.06 percent in the Q4 of 2023. In the previous quarter, the GDP stopped the upward trend and decreased to 4.94 percent y-o-y from 5.17 percent y-o-y in Q2 of 2023.

The International Monetary Fund raised its global growth forecast for 2024, pointing to the better-than-expected performance of the U.S. and Chinese economies last year, as Asian emerging and developing markets remain the driving force.

The World Economic Outlook projects global growth to reach 3.1% in 2024, 0.2 percentage points higher than the previous forecast in October but unchanged compared with last year’s growth. It also remains well below the pre-pandemic 20-year average of 3.8% annual growth.

The International Monetary Fund (IMF) forecasts global economic growth to reach 3.1 percent in 2024 and 3.2 percent in 2025. Meanwhile, Indonesia is expected to achieve a growth rate of 5 percent for the current year and the following year.

“Global activity proved resilient in the second half of last year, as demand and supply factors supported major economies. On the demand side, stronger private and government spending sustained activity, despite tight monetary conditions.

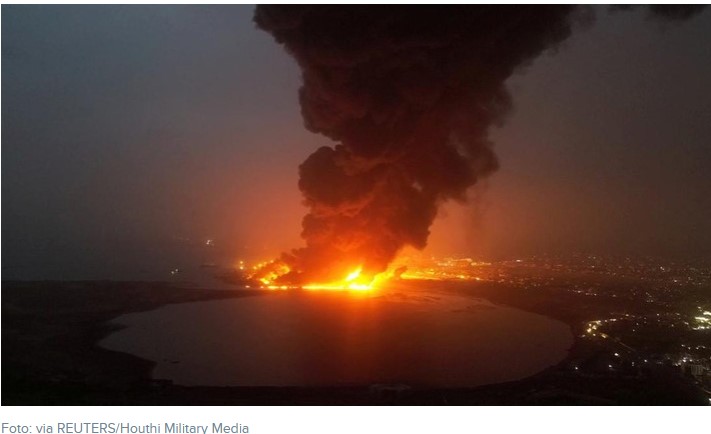

On the supply side, increased labor force participation, mended supply chains, and cheaper energy and commodity prices helped, despite renewed geopolitical uncertainties,” IMF chief economist Pierre-Olivier Gourinchas.

Indonesia’s economy grew 5.0% in the fourth quarter from a year earlier, supported by resilient domestic consumption, despite exports shrinking and commodity prices falling, a Reuters poll of 23 economists found.

Growth in Southeast Asia’s largest economy was mostly driven by private consumption which remains strong against a cumulative 250 basis points of interest rate hikes by Bank Indonesia since August 2022.

The poll median for 5.00% growth last quarter from the previous year was slightly faster than the 4.94% expansion in the preceding quarter. The latest data will be released on Feb. 5.

Indonesia’s economy grew 5.05% in 2023 from a year earlier, slowing from a 5.31% expansion the previous year due to weaker growth in exports, official data showed on Monday.

According to data released by the government agency Statistics Indonesia, household consumption, which makes up over half of Indonesia’s gross domestic product, increased 4.82% last year compared to 4.94% in 2022.

Acting Head of Indonesia’s Central Statistics Agency (BPS) Amalia Adininggar Widyasanti announced on Monday that Indonesia’s economy had grown by 5.05 percent in 2023.

At a press conference held in Jakarta, she explained that all business sectors experienced positive growth in 2023.

Business sectors, with the biggest contribution to economic growth, are the processing industry, trade, agriculture, mining, and construction.

The Indonesian Finance Ministry projected that the country’s economy will remain strong this year, taking into account global dynamics and the potential of the domestic economy.

“Indonesia’s economy is estimated to grow strongly by 5.2 percent in 2024,” the Finance Ministry’s Head of the Communications and Information Services Bureau, Deni Surjantoro, said in his official statement.

Since the global economy is anticipated to keep slowing down this year, Deni said the government would continue to monitor the risks.

Indonesia’s economic landscape has undergone a transformation, solidifying its position as Southeast Asia’s largest economy with a GDP exceeding 1 trillion USD and a growth rate of 5% in 2023.

While global economies grappled with the fallout of a volatile international market, Indonesia managed to attract 24 billion USD in investments in the third quarter of 2023 alone, marking a 7% increase. The rise of Foreign Direct Investment (FDI) by 4.7 billion USD in September 2023 underscores the international confidence in the Indonesian market, with China emerging as the second-largest investor.

While the economic prospects of Indonesia continue to thrive, it’s the country’s legal system that serves as the backbone, steering its economic trajectory. Mediation, a cornerstone of the Indonesian judicial system, serves as a culturally accepted norm and a legal requirement in civil trials. Despite the availability of seven recognized mediation bodies, arbitration remains a challenge due to non-alignment with the UNCITRAL Model Law and enforcement issues.

Transparency International Indonesia (TII) announced Indonesia’s Corruption Perception Index (IPK) score for 2023 of 34 out of 100, the same as the previous year.

TII Deputy Secretary-General Wawan Suyatmiko said that Indonesia’s global ranking has dropped to 115th out of 180 countries, down from 110th the previous year. Meanwhile, Indonesia ranked sixth among other ASEAN countries, below Timor-Leste which ranked third.

Indonesia holds the sixth position among ASEAN countries in Transparency International’s Corruption Perception Index (CPI) for 2023.

Indonesia Corruption Watch or ICW launched the digital platform RekamJejak.net to understand the track records of legislative candidates ahead of the general elections.

ICW researcher Tibiko Zabar cited the data of the Corruption Eradication Commission from 2004 until July 2023 that over 344 corruption cases involved members of the (House of Representatives). Hence, this platform emerged to highlight to the candidates’ track records.