Ruble-The Moscow Times

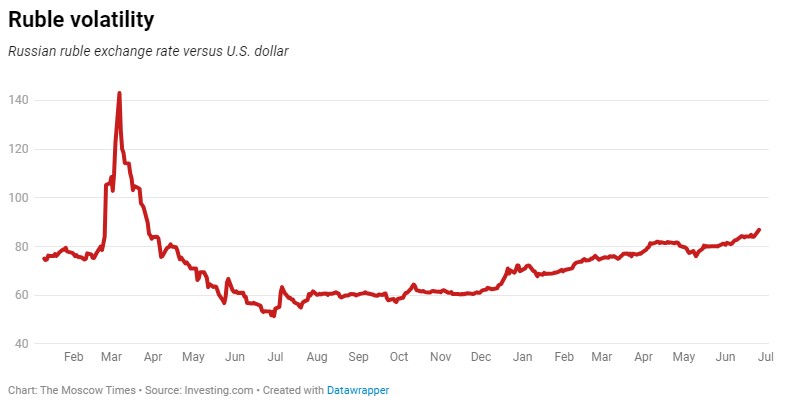

STRATEGIC ASSESSMENT. The Russian ruble temporarily fell to its lowest level since March 2022 on Monday morning as financial markets digested the fallout from Yevgeny Prigozhin’s failed insurrection against Russia’s military leadership.

The Russian currency initially slumped by more than 2%, falling past 87 against the U.S. dollar in the first minutes of trading in Moscow — its weakest level since March 29, 2022 — before recovering some losses later in the session.

The ruble has traded with extreme volatility in the 16 months since Russia invaded Ukraine as the West has targeted Moscow’s foreign currency reserves and crucial energy exports through sanctions designed to cripple Russia’s economy.

After falling beyond 100 against the dollar in the days after Russia invaded, strict capital controls, surging energy prices and a collapse in Russian imports pushed the currency to become the world’s best-performing currency for much of 2022. But Europe halting purchases of Russian oil and gas along with measures such as the G7’s oil price cap have put pressure on the ruble once more over the last six months.

The ruble has lost 23% so far in 2023. As trading picked up on Monday the currency pared some losses and was trading around 85.2 against the U.S. dollar.

Analysts said the fact the Kremlin and Prigozhin appear to have struck some kind of deal to quash the coup helped avoid a deep crisis in Russian and global markets.

“The fact that it was almost over before it had begun means that markets will react in a very different way. If it had continued, if there had been some threat of civil war in Russia, then I think it would have caused absolute havoc in financial markets,” said Kathleen Brooks, a director at Minerva Analysis.

Global commodity prices, from crude oil to grains, are highly sensitive to developments in Russia and Ukraine, two of the world’s most important agricultural exporters.

Russian banks had initially hiked foreign exchange rates by as much as 10% on Friday evening after Prigozhin announced he was sending a convoy of troops to Moscow in a bid to remove Defense Minister Sergei Shoigu and Chief of the General Staff Valeriy Gerasimov over what he said was their incompetence and failure to secure victory in Ukraine.

Russia’s largest brokerage, Tinkoff Investments, also halted off-market weekend trading in Russian stocks on Saturday after retail traders started offloading shares, fearing a market collapse when full trading resumed.

While that has been avoided, Russian analysts said to expect heightened volatility in the days ahead as traders and investors remain nervous.

“Although the tension eased towards the end of the weekend, the emotional trail may still be around for some time, putting pressure on the stock market. The impression that something can happen at any moment will deter a certain category of investors from buying,” said Igor Galaktionov, an expert at Moscow-based brokerage BCS Express.

Russian financial markets were trading as usual on Monday, while many Muscovites stayed home after Mayor Sergei Sobyanin announced Monday would be a “non-working day” amid a heightened state of alert in the Russian capital.

Russia’s MOEX index, which had fallen by more than 2% in late evening trading on Friday after Prigozhin announced his so-called “march for justice,” climbed 0.5% at the start of trading in Moscow.