Foto diambil dari www.liputan6.com

STRATEGIC ASSESSMENT. Bank Indonesia (BI) Governor Perry Warjiyo at the 2023 Jakarta Economic Outlook National Seminar said the central bank projects that inflation will fall to a level of 1.5 to 3.5 percent in 2024 after possibly lying in the range of two to four percent in 2023. Currently, inflation is recorded at 5.42 percent as of November 2022 as compared to the same period last year or on a year-on-year (yoy) basis.

He said the synergy to reduce inflation was driven by energy subsidies by the government, a measurable increase in BI interest rates, measures to stabilize the rupiah by BI, and the close coordination of Central and Regional Inflation Control Teams (TPIP and TPID), including the National Movement for Food Inflation Control (GNPIP).

Global research coalition Climate Action Tracker (CAT) categorizes Indonesia’s climate goals as “Critically Insufficient,” which means they are far from enough to curb global warming.

This is the lowest possible rating on CAT’s scale. The rating means that “if all countries in the world followed Indonesia’s target, the global temperature would rise by 4℃,” said Anindita Hapsari, a member of the CAT Country Assessment Team from the Institute for Essential Services Reform (IESR), in a public discussion in Jakarta.

Even if those strategies go as planned, they are still insufficient to meet the Paris Agreement target. According to CAT, by 2030 Indonesia’s annual greenhouse emissions will be 1,710-1,805 million tons of carbon dioxide equivalent. This is much higher than the level of emissions that would align with the Paris Agreement, which is no more than 1,000 million tons of carbon dioxide equivalent per year.

The Asian Development Bank (ADB) has approved a loan of $138.52 million to support the Indonesian government’s strategy of commercializing research and innovation, as well as enhancing the success of startups in Indonesia’s four science and technology regions.

The project will support science and technology areas in well-known state higher education institutions, including the Bandung Institute of Technology (ITB), Gadjah Mada University (UGM), Bogor Agricultural (IPB) University, and the University of Indonesia (UI), in order to strengthen research and innovation through a modern and efficient science and technology area.

Internet crackdowns from Vietnam to Bangladesh cause self-inflicted economic harm by raising the cost of doing business and risk cutting trade by up to nine percent in some of Asia’s investment destinations, a think tank says.

Countries that force companies to store data on local servers — an increasingly common policy among Asian governments — are chasing a “false allure of data nationalism” that only increases import and other business expenses, says a report by the Information Technology and Innovation Foundation released. US.-based ITIF crunched numbers on five territories, including Hong Kong, Indonesia, and Pakistan, linking a one-unit rise on a data restrictiveness index to a 0.5 percent drop in annual trade.

Next year Indonesia will face a perfect storm in the form of a global economic slowdown, high inflation and geopolitical tension. In its World Economic Outlook October 2022 report, the International Monetary Fund (IMF) again lowered its 2023 global economic growth projection to 2.7 percent, from 2.9 percent in July 2022 and 3.8 percent in January 2022.

The IMF also predicted that 31 countries representing 43 percent of the world economy would experience an economic recession in 2023. Other prominent international institutions such as the World Bank and OECD conveyed the same message.

Bank Indonesia (BI) Governor Perry Warjiyo forecasted annual economic growth of 4.5 to 5.3 percent in 2023. He said downstream natural resource commodities, infrastructure development, foreign investment, and the moving tourism sectors will also support the economy next year.

He also predicted that global inflation would begin to fall in the second half of 2023. Even so, he was confident that dynamics in the economy will cause new inflation to fall by the end of the year. The risk is that a high-interest-rate environment will prevail in the coming year.

President Jokowi at the Bank Indonesia (BI) Annual Meeting said that the world’s two economic giants, the United States and China, are experiencing an economic slowdown. However, China’s economic situation becomes more dangerous for Indonesia’s economy.

According to a recent Reuters poll of 40 economists, China’s economy will grow by 3.2 percent in 2022, well below the government’s target of 5.5 percent. If the year 2020 is excluded, when the world was hit by COVID-19 pandemic, then GDP growth was the slowest since 1976.

Bank Indonesia (BI) Governor Perry Warjiyo expressed concern about the impact of China’s COVID-19 lockdown policy on the Indonesian economy. He said that the local community has been strongly opposed to the implementation of the lockdown policy due to the disruption of social and economic activities. He also said that BI is concerned about the fallout from the wars in Russia and Ukraine, which have disrupted the supply chain of trade in goods and services, negatively impacting the economies of developing countries such as Indonesia.

Vice President Ma’ruf Amin said the government’s decision to import rice aimed to anticipate a shortage in national rice stocks. He said the government has, so far, made every effort to boost the implementation of the food crops intensification program. Ma’ruf said during his visit to South Sulawesi, he received a report that the local government had conducted an intensification program to boost rice production, ranging from preparing seeds to cultivating farmland.

Trade Minister Zulkifli Hasan said the State Logistics Agency (Bulog) had imported 350,000 tons of soybeans from the United States on President Jokowi’s direct order. He said the soybean stocks are expected to arrive in Indonesia by the end of December 2022 or early January 2023. He stated that Bulog purchased the soybeans at the price of IDR11,000 to IDR12,000 for one kilogram and will later sell them at IDR10,000 to IDR11,000 due to a government subsidy of IDR1,000 per kilogram to cover the price difference.

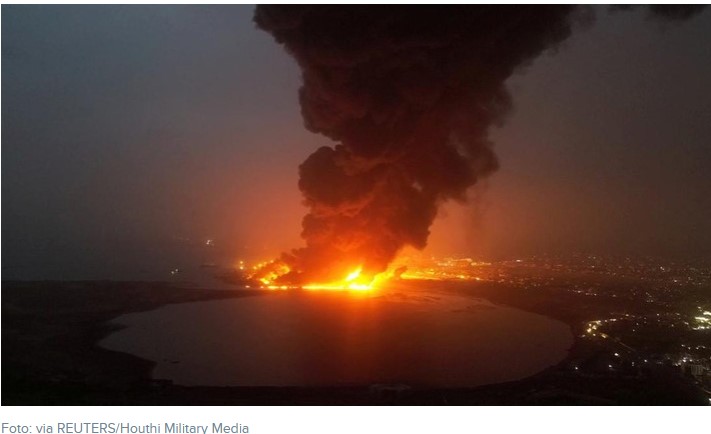

Energy and natural resources issues

The Indonesian economy has been affected through both trade and financial channels. The impact through the trade channel can be seen in massive worker layoffs in textile and footwear companies due to the weakening global demand. Meanwhile, the impact through the financial channel can be seen in the capital outflows as foreign-portfolio investors unloaded their rupiah assets as government bonds.

As Indonesia promises a zero-carbon economy by 2060, we suggest five principles essential for implementation in policy and practice that can ensure the transition benefits a wide coalition of people compared to only a selected few.

In November at the G20 meeting in Bali, Indonesia launched a $20 billion Just Energy Transition Partnership which includes a promise to make the Indonesian economy net-zero carbon by 2060. And while Indonesia is still building coal power plants, debates about an early retirement of existing coal power stations have recently gained traction. These are significant promises especially given that Indonesia is the second largest coal producing country in the world after China.

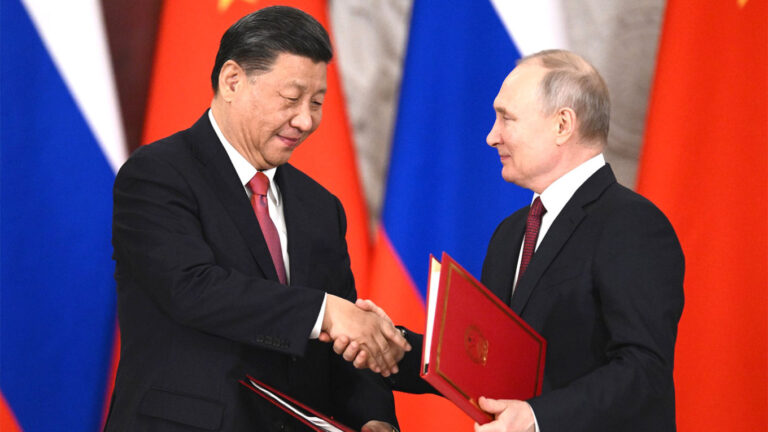

Russia and China have lifted the moratorium on fertilizer raw material shipments that had been in place since last year as geopolitical tensions rose due to the Russo-Ukrainian War. State-owned fertilizer company Pupuk Indonesia Spokesperson Wijaya Laksana said with the lifting of the prohibition, Indonesia will once again import phosphate and potassium raw materials from Russia and China for fertilizer manufacture next year.

Wijaya did not specify how much phosphate and potassium raw materials would be imported from these countries. According to Statistics Indonesia (BPS) data, Indonesia imported 1.8 million tons from Canada, 1.78 million tons from China, 1.13 million tons from Belarus, and 974,000 tons from Russia.

Indonesia was filed an expected appeal against a World Trade Organization (WTO) panel ruling that was in favor of the European Union (EU) in a dispute over Jakarta’s ban on nickel ore exports, the WTO said.

The WTO panel ruled in favor of the EU last month, saying that neither the prohibition of nickel exports nor a domestic processing requirement requiring all nickel ore to be refined in Indonesia were in line with global trade rules, prompting President Jokowi to say that his country would appeal the ruling.

The Indonesian government has claimed that its raw nickel export ban, which started in January 2021, has shown positive impacts after seeing increases in mining investments and exports of nickel-derived products.

Indonesia has filed an appeal against the World Trade Organization to assert its right to ban exports of metal ores. The appeal was sent to WTO members on Monday, according to a notice on the organization’s website. WTO had earlier ruled in favor of the European Union’s complaint that Indonesia’s ban on nickel ore exports was hurting its steel industries.

The dispute started in 2021 when the EU asked for the establishment of a panel, saying that the Southeast Asian country’s requirement for minerals to be processed locally and its failure to promptly publish the policy are inconsistent with WTO rules.

A panel of WTO experts last month urged the country, which is the world’s largest nickel ore producer, to bring its measures in line with WTO obligations. The ruling could jeopardize Indonesia’s bid to push the resource-rich nation up the commodities value chain and develop local metal refineries.

In Montreal, the United States and other western countries announced an alliance to produce and buy critical minerals from countries with stronger environmental and labor standards, a move that could reduce business with market leader China.

President Jokowi said he would soon suspend the export of raw bauxite after the cessation of nickel raw material exports some time ago. He said that industrial downstreaming must continue to increase the value of Indonesia’s investment. Jokowi instructed Trade Minister Zulkifli Hasan to seek potential countries with high demand in the event that major markets like China and the United States abruptly reduced their demand for Indonesia’s exports.

Following Indonesia’s defeat in a World Trade Organization (WTO) lawsuit challenging the nickel ore export ban, Finance Ministry’s State Income Policy Center Chair Pande Putu Oka Kusumawardhani said on the sidelines of the Annual International Forum on Economic Development and Public Policy (Al-FED) 2022 in Bali that the government would implement a “dual strategy” through fiscal and trade channels.

In addition to filing an appeal with the WTO, plans for the imposition of export duties or taxes on nickel ore are in the finalization stage. Pande Putu said that discussions about instituting a nickel ore export tax are currently underway, in tandem with the government’s efforts to file an appeal with the WTO.

State electricity company PLN Director Adi Lumakso in a panel discussion said the company is aiming to retire at least 6.7 gigawatts of fossil-energy-based power plants by 2030 to reduce reliance on fossil energy and transition to new renewable energy.

Indonesia needs to improve transparency of its power plant shutdown plans, the Institute for Energy Economics and Financial Analysis (IEEFA) said on Friday, as the country launches at least five energy transition schemes.

Indonesia has in recent months announced agreements with international groups to finance its transition away from coal into renewable energy, including a $20 billion deal arranged by G7 countries under the Just Energy Transition Partnership (JETP) and the Climate Investment Funds (CIF) $500 million allocation of concessional financing.

The IEEFA report said that under the CIF program, state-run electricity company PLN would shut down nine coal power plants with a total 4.9 gigawatt of capacity, but some were already “very old” and “beyond their economic useful life by 2055,” the year by which they are due to be decommissioned.

According to the World Risk Report 2022 published by Bündnis Entwicklung Hilft and IFHV of the Ruhr-University Bochum, Indonesia is one of the world’s most disaster-prone countries, trailing behind the Philippines and India. Both countries have global risk index scores of 46.82 and 42.31, respectively. World Resources Institute (WRI) Indonesia’s score is made up of five components: exposure, vulnerability, susceptibility, lack of coping capacities, and lack of adaptive capacities.

The Marine Affairs and Fisheries Ministry asserted that the Widi Islands — which was previously widely reported up for auction in the Sotheby’s Concierge Auctions — remains in Indonesia’s control as guaranteed by the law. “Our regulations do not recognize and do not legalize transact sales of islands, including small islands which are public rights and state assets,” said Ministry spokesperson Wahyu Muryadi.

According to Indonesia’s law, Wahyu said, the Widi Islands cluster cannot be owned by a foreign citizen and must not be transacted, especially considering that 83 of the smaller islands in the cluster are protected forests.