STRATEGIC ASSESSMENT. Saxo Bank has released its annual “outrageous predictions” for the new year, saying 2023 will be rocked by wartime economic policies, a UK vote to rejoin the European Union, the resignation of French President Emmanuel Macron, and a revolt by China, India and OPEC against the “weaponization” of the dollar.

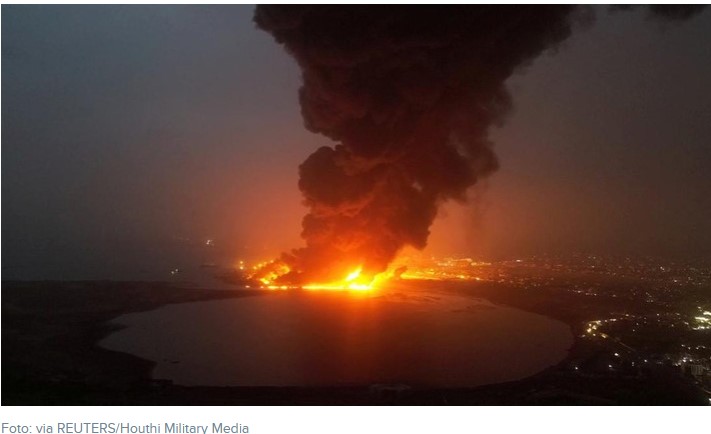

“Any belief in a return to the disinflationary pre-pandemic dynamic is impossible because we have entered into a global war economy, with every major power across the world now scrambling to shore up their national security on all fronts,” Saxo chief investment officer Steen Jakobsen said in a statement. That scenario applies, he added, “whether in an actual military sense, or due to profound supply-chain, energy and even financial insecurities that have been laid bare by the pandemic experience and Russia’s invasion of Ukraine.”

The Danish investment bank predicted that widespread price controls would be imposed as governments in countries such as the US and the UK fail to curb rampant inflation, contributing to a surge in gold prices to $3,000 an ounce. “In a war economy, the government hand will expand mercilessly as long as price pressures threaten stability,” Jakobsen said, adding that the Western effort to cap Russian oil prices is likely doomed to failure.

Political turmoil in the recession-wracked UK will lead to a referendum vote on reversing Brexit, after the Labour Party takes power in the third quarter, Saxo said. The ‘Rejoin’ vote will likely win, contributing to a stronger performance by the British pound.

The bank said its 2023 predictions, including an agreement to form an EU army, were inspired partly by similarities between Europe today and the continent’s state in the early 20th century. “The Ukrainian invasion has brought a war economy mentality to Europe on a scale not seen since 1945. And it’s not just about the woefully inadequate military capabilities in Western Europe, but also about an industrial, Germany-centered model that has been rendered existentially challenged by Europe cutting itself off from cheap and plentiful Russian oil and gas.”

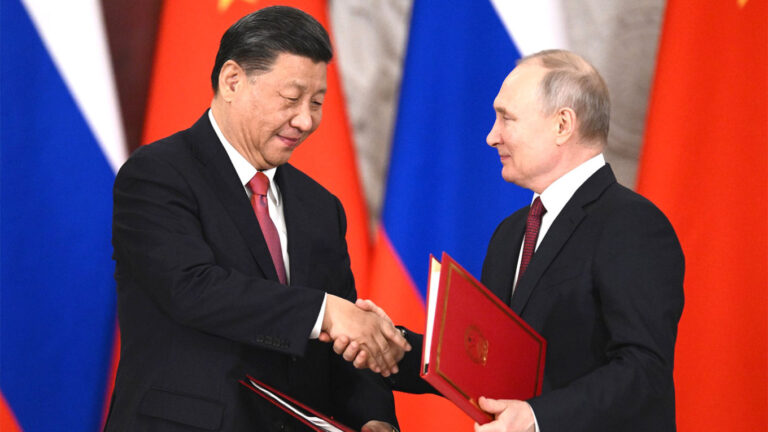

China, India and OPEC will push back against US dominance of the global monetary system by creating an international clearing union and a new reserve asset, Saxo predicted. US-led financial sanctions against Russia over the Ukraine crisis “sent shockwaves” across countries not allied militarily with Washington, the bank said.

Other predictions included Japan pegging the yen at 200 to the US dollar to “reset” its financial system, at least one country announcing a ban on meat production by 2030, and tweaking of financial laws to eliminate tax havens and close tax loopholes for hedge funds.

Saxo is known for making bold predictions that are meant to get investors thinking about the outrageous things that could happen in the year ahead. Some of the bank’s 2022 predictions were at least directionally accurate, if not precise in terms of scale. For instance, Saxo said a new Cold War could break out on multiple fronts, and an accelerating space race would intensify the US-China rivalry. The bank also saw Facebook losing market share because of its subpar appeal to young people. Facebook’s parent, Meta Platforms, has lost two-thirds of its market value this year.