STRATEGIC ASSESSMENT. World leaders of the Group of 20 concluded when nearly all member nations are battling sky-high inflation rates. While it stayed steady in Canada in October compared to the previous month, inflation remains stubbornly high across many G20 nations and is yet to fall to pre-pandemic levels. Through a declaration, the G20 economies agreed to pace interest rates to avoid any “cross-country spillovers.”

So far, Argentina tops G20 economies with a staggering inflation rate of 88 per cent in October, surpassing Turkiye’s at 85.5 per cent. Amongst the advanced G20 economies, the U.K. faces the second-highest inflation of 11.1 per cent, after Italy recorded 12.8 per cent in October 2022.

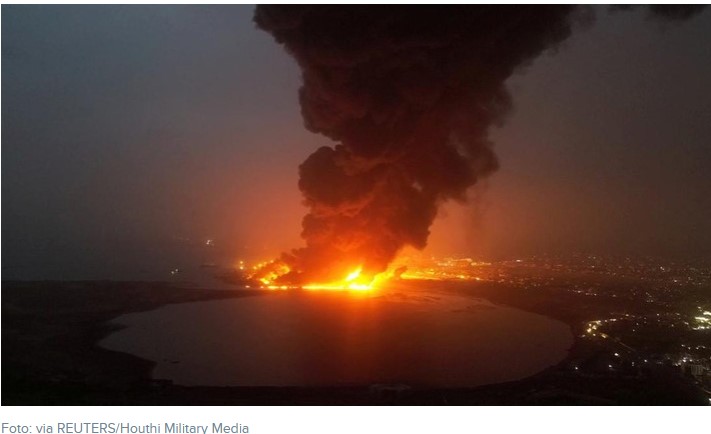

So far, the high inflation rates have led to food insecurity, and coupled with Russia’s invasion of Ukraine, and persistent pandemic effects, it has become “increasingly evident” that there is a slowdown in global economic growth, according to the International Monetary Fund (IMF) experts tracking the progress of the Group of Twenty (G20) economies.

Although the jobs market remained surprisingly strong in September, the Fed is working hard to change that by aggressively raising interest rates to ease demand for everything from cars and homes to appliances. The pace of job growth is expected to be roughly cut in half during the fourth quarter of this year, Bank of America told clients in a report Friday.

As pressure from the Fed’s war on inflation builds, nonfarm payrolls will begin shrinking early next year, translating to a loss of about 175,000 jobs a month during the first quarter, the bank said. Charts published by Bank of America suggest job losses will continue through much of 2023.

More U.S. companies are cutting jobs and freezing hiring as the economy cools, a sign that efforts by the Federal Reserve to tamp down inflation are hitting the labor market. Layoff announcements spiked in September, according to outplacement firm Challenger, Gray & Christmas. Job cuts last month rose to nearly 30,000, an increase of 46% from August, while the number of companies announcing hiring plans last month fell to the lowest level in more than a decade, the firm said.

Economists have revised down 2023 growth forecasts for Southeast Asia’s five biggest economies over concerns about a global slowdown amid rising interest rates in the U.S. gross domestic product for Indonesia, Malaysia, the Philippines, Singapore, and Thailand is expected to rise 4.3 percent in 2023, according to the latest quarterly survey by the Japan Center for Economic Research and Nikkei in September.

Each country’s growth was revised down. The outlook for Indonesia was cut to 4.9 percent from 5.1 percent, Malaysia 4.0 percent from 4.6 percent, the Philippines 5.4 percent from 5.6 percent, Singapore 2.2 percent from 3.5 percent, and Thailand 3.7 percent from 4.4 percent.

Meanwhile, Indian and Indonesian bonds are offering shelter from extreme volatility in global markets. The two countries’ sovereign debt only lost 0.4 percent and 1.5 percent respectively for dollar-based investors in the third quarter, less than other emerging markets in Asia including China, according to data compiled by Bloomberg.

They knocked China off the top spot as the best performer in the region. Indian and Indonesian notes have the widest spreads in emerging Asia, helping to shield investors from the turmoil in the U.S. Treasuries, which had the longest string of quarterly losses in almost a decade.

IMF Managing Director Kristalina Georgieva urged 190 member countries to prepare for the impending “severe storm” of the global economic crisis. The IMF deemed that the two years of the COVID-19 pandemic, which was followed by the Russo-Ukrainian War, had a significant impact on global trade activity and financial market turbulence.

Meanwhile, the G20 presidency of Indonesia for the past year has searched out the finest answers to world issues. The success of Indonesia’s presidency was recognized by adopting and ratifying the G20 Bali Leaders’ Declaration. Many countries have praised Indonesia’s success in the midst of different global crises and problems.

Indonesia is the sole representative of Southeast Asia and one of the G20 forum’s pivotal developing countries. The magazine The Economist even dubbed Indonesia as “Asia’s Overlooked Giant.” Furthermore, there was a moment of launching Indonesia’s cooperation commitment with the United States in the Partnership for Global Infrastructure and Investment (PGII) scheme during the G20 Summit.

Under the PGII scheme, the United States will mobilize $600 billion in funding for infrastructure development in developing countries over the next five years. Indonesia has also obtained a commitment from the Just Energy Transition Program (JETP), in which the G7 countries will provide $20 billion (IDR 311 trillion) over the next three to five years to finance emission-reduction projects.

Indonesia’s economic portrait during 2022 and its trajectory in 2023

President Jokowi said the global economic recession was expected to start early in 2023 while urging all government officers to not work as usual and to always have a sense of crisis. The President advised all government officers to exercise caution in formulating policies since unfitting policies would have a fatal impact. All governmental elements should realize that the current situation is not easy, not only for Indonesia but developed countries were also facing difficult times.

Multiple high-ranking government officials have raised serious concerns about the economic hardships to be faced in 2023, noting the necessity to mitigate such risk. President Joko “Jokowi” Widodo explained that Indonesia and many other countries were facing economic woes that will be prolonged into 2023, and he expects a global recession to start “early next year”.

The 2023 State Budget focuses on six points, according to President Jokowi, who were submitted the Budget Implementation Entry List (DIPA) and the Allocation List of Transfers to Regions and Village Funds (TKKD) for the 2023 fiscal year at the State Palace. The state budget will be used to improve human resources, to speed up social welfare reform, to keep building infrastructure, to expand infrastructure to support the growth of new economic hubs, including the new capital of Nusantara, to revive the industrial sector by maintaining downstreaming incentives, and to enhance regulatory simplification and bureaucratic reform. President Jokowi also asked regional heads to routinely check the movement of the inflation rate in their respective regions because the current inflation rate is a scourge of all countries.

Indonesia maintained an impressive 5.72% year-on-year gross domestic product (GDP) growth in the third quarter of this year, while bringing down inflation to 5.71% in October from 5.95% in the previous month. However, signs of a slowdown have become more visible in recent days as the country’s manufacturing purchasing managers’ index, an indicator of industry health by S&P Global, has fallen in October with export orders being the main factor.

Indonesia must remain alert against five potential global risks that could affect national economic growth and recovery in 2023, Bank Indonesia (BI) Governor Perry Warjiyo said during the 2022 Bank Indonesia Annual Meeting on Wednesday. He said the risks including the slow growth trend and the increasing recession risk in the United States and Europe.

Also the high inflation due to surging food and energy prices, the high interest rate including the Federal Funds Rate which could reach five percent and remain high next year, the strengthening of the U.S. dollar, which could lead to a depreciation in other currencies including the Indonesian rupiah, and fund withdrawals by global investors seeking to redirect their assets to liquid assets due to high economic risk.

Finance Minister Sri Mulyani said she predicted that the world would plunge into a recession in 2023, triggered by high inflation due to the soaring food and energy prices in a number of countries, especially in Europe and the United States. High inflation triggers central banks in developed countries to raise interest rates and tighten liquidity, she added. The Federal Reserve’s fight to squash inflation will cause the US economy to start losing tens of thousands of jobs a month beginning early next year, Bank of America warns. Finance Minister Sri Mulyani said she guaranteed that the 2023 State Budget deficit would be below three percent, at IDR598.2 trillion or 2.84 percent specifically. Minister Sri also emphasized that Indonesia should be aware of the food, energy, and financial crises that can potentially occur in 2023, especially in countries without a strong foundation.

The Indonesia’s government was aware of the risk of declining foreign direct investment in line with the slowdown in China’s economy and the mounting risk of a global recession. China’s economic slowdown will definitely affect the global economy, including Indonesia. This is because China is the second largest economy in the world and is an important trading partner for dozens of countries.

Indonesian investment authority is formulating strategies to continue to gain foreign direct investment amidst the wait-and-see action of investors. It has prepared a number of strategies, including diversifying the country of origin of investment sources that focus on increasing added value, as well as spurring downstream.

Indonesia remains an attractive place for technology investments, according to the e-Conomy SEA 2022 report. Global investment company Temasek official Fock Wai Hoong on Tuesday said Indonesia’s digital economy will continue to attract investment because of its strong fundamentals, such as having a large, highly active user base and a dynamic technology start-up ecosystem.

Indonesia has attracted 25 percent of the total value of private funding in the region and in the long term, it will remain attractive to investors along with Vietnam and the Philippines. Digital financial services have replaced the e-commerce sector as the top investment sector by reaching a value of $1.5 billion in the first half of this year.

Google Indonesia Managing Director Randy Jusuf said Indonesia’s e-commerce sector recorded the fastest growth after Vietnam. According to the e-Conomy SEA report, he said the country’s digital economy was projected to reach a Gross Merchandise Value (GMV) of $77 billion by 2022 after growing 22 percent in the past year. He also said the e-commerce sector continues to drive the digital economy, and its value is estimated to reach $59 by 2022. E-commerce accounts for 77 percent of the entire digital economy albeit the return of on-site shopping activities. Randy also projected that transportation and food delivery services may reach a GMV of $8 billion by 2022.

The country’s foreign direct investment and domestic direct investment have remained solid, collectively growing by 35.5 percent year-over-year (yoy) as of Q2 of 2022. Indonesia leads its neighbors in export growth, with a 32 percent yoy growth and trade surplus.

Its digital economy has hit approximately US$77 billion this year with an approximate 22 percent yoy growth in gross merchandise volume. The sector is on course to become a $130 billion digital market by 2025, fueled primarily by e-commerce, similar to its ASEAN neighbors.

The Indonesian Central Bureau of Statistics recently released the latest data showing that driven by continued export growth and improved investment, the country’s GDP grew by 5.72% year-on-year in the third quarter of this year, continuing the momentum of economic recovery that began in the second quarter of 2021.

From the perspective of industry data, except for the health service sector, Indonesia’s major economic sectors have achieved growth in the third quarter. Among them, industry, agriculture, trade and construction continued to recover, contributing 66.45% to Indonesia’s economic growth, which was Economic growth instills stability.

The growth of multiple industries has led to an increase in domestic and foreign investment in Indonesia. Indonesian Ministry of Investment introduced that under the impetus of investors from China, Singapore, Japan and other countries, Indonesia attracted a record 169 trillion rupiah of foreign direct investment in the third quarter (1 yuan is about 2193 rupiah) a year-on-year increase of 63%.

Maritime Affairs and Investment Coordinating Minister Luhut Binsar Pandjaitan said investment worth $30.9 billion in the downstreaming sector is ready to be executed to provide benefits to the Indonesian economy. According to the minister, investment is in the construction stage and/or awaits approval. Luhut added the investment pipeline reached $30.9 billion until 2026, and it is spread in Kalimantan, Sulawesi, to North Maluku.

President Jokowi previously mentioned the investment realization target to Investment Minister Bahlil Lahadalia. He warned that the Rp 1,200 trillion investment target must be met. He explained that if the target is not met, Indonesia’s economic growth will suffer as well.

Many investors are interested in Indonesia’s new capital city or IKN Nusantara project, said Minister of Public Works and Housing (PUPR) Basuki Hadimuljono. With the high interest of foreign investors, the official was optimistic that the project could be mainly funded from investment instead of the state budget, reported Indonesian weekly magazine Tempo.

He listed a series of sectors for the investment, including road construction, drinking water, education, and hospitals. According to the minister, the Indonesian Government has worked with the Malaysian and Japanese sides to hold forums to promote investment in the project. PUPR spokesperson Endra Atmawidjaja said at least 183 Malaysian investors, working in the sectors of property, health, digital, startup, transportation, and energy, are interested in investing in the new capital city.

It must be underlined that global pundits have warned that 2023 global trade and finance market still murky, then every countries are going to be carefull to investment or anything policy related to finance business. Those conditions must be attentioned by the government of Indonesia if they do not want Indonesia’s economic chaotic will happen. The development of an infrastructure new capital city in East Kalimantan and the preparation of simultaneous 2024 general elections (both presidential election and legislative election) are facing seriously problems which are needed to wise overcome. The Coordinating Ministry for Economic Affairs has stated that Indonesia is now targeted to become a developed country by 2043. This is a pushback from an initial target of becoming advanced by 2036-2038 (TE).