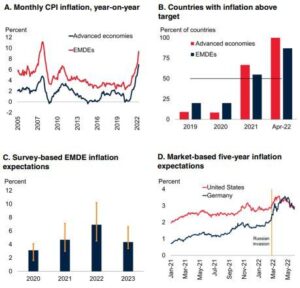

STRATEGIC ASSESSMENT. Finance Minister Sri Mulyani, in a virtual press conference on Monday, said she predicted that the world would plunge into a recession in 2023, triggered by high inflation due to the soaring food and energy prices in a number of countries, especially in Europe and the United States. High inflation triggers central banks in developed countries to raise interest rates and tighten liquidity, she added. The Federal Reserve’s fight to squash inflation will cause the US economy to start losing tens of thousands of jobs a month beginning early next year, Bank of America warns.

Although the jobs market remained surprisingly strong in September, the Fed is working hard to change that by aggressively raising interest rates to ease demand for everything from cars and homes to appliances.

The pace of job growth is expected to be roughly cut in half during the fourth quarter of this year, Bank of America told clients in a report Friday.

As pressure from the Fed’s war on inflation builds, nonfarm payrolls will begin shrinking early next year, translating to a loss of about 175,000 jobs a month during the first quarter, the bank said. Charts published by Bank of America suggest job losses will continue through much of 2023.

Economists have revised down 2023 growth forecasts for Southeast Asia’s five biggest economies over concerns about a global slowdown amid rising interest rates in the U.S. gross domestic product for Indonesia, Malaysia, the Philippines, Singapore, and Thailand is expected to rise 4.3 percent in 2023, according to the latest quarterly survey by the Japan Center for Economic Research and Nikkei in September.

The figure reflects a downward revision from 4.8 percent in the June survey. Each country’s growth was revised down. The outlook for Indonesia was cut to 4.9 percent from 5.1 percent, Malaysia 4.0 percent from 4.6 percent, the Philippines 5.4 percent from 5.6 percent, Singapore 2.2 percent from 3.5 percent, and Thailand 3.7 percent from 4.4 percent.

Meanwhile, Indian and Indonesian bonds are offering shelter from extreme volatility in global markets. The two countries’ sovereign debt only lost 0.4 percent and 1.5 percent respectively for dollar-based investors in the third quarter, less than other emerging markets in Asia including China, according to data compiled by Bloomberg.

They knocked China off the top spot as the best performer in the region. Indian and Indonesian notes have the widest spreads in emerging Asia, helping to shield investors from the turmoil in the U.S. Treasuries, which had the longest string of quarterly losses in almost a decade.

More U.S. companies are cutting jobs and freezing hiring as the economy cools, a sign that efforts by the Federal Reserve to tamp down inflation are hitting the labor market.

Layoff announcements spiked in September, according to outplacement firm Challenger, Gray & Christmas. Job cuts last month rose to nearly 30,000, an increase of 46% from August, while the number of companies announcing hiring plans last month fell to the lowest level in more than a decade, the firm said.

“Some cracks are beginning to appear in the labor market. Hiring is slowing and downsizing events are beginning to occur,” Andrew Challenger, senior vice president of Challenger, Gray & Christmas, said in a statement.

Investment Ministry Deputy Indra Darmawan said the government was aware of the risk of declining foreign direct investment in line with the slowdown in China’s economy and the mounting risk of a global recession.

Indra said that China’s economic slowdown will definitely affect the global economy, including Indonesia. This is because China is the second largest economy in the world and is an important trading partner for dozens of countries.

Indonesian investment authority is formulating strategies to continue to gain foreign direct investment amidst the wait-and-see action of investors. It has prepared a number of strategies, including diversifying the country of origin of investment sources that focus on increasing added value, as well as spurring downstream.

The World Trade Organization (WTO) expects significant headwinds for global trade next year, and Indonesian producers will not go unscathed. Trade Ministry Policy Agency Chair Kasan Muhri expects industrial exports of jewelry, timber, copper, home appliances, synthetic fibers, and fruits to plunge, continuing a trend of the past 12 months.

“Consumers around the globe will tend to withhold spending and save money, leading to a global drop in demand, especially for nonessential consumer goods,” Kasan said to The Jakarta Post.

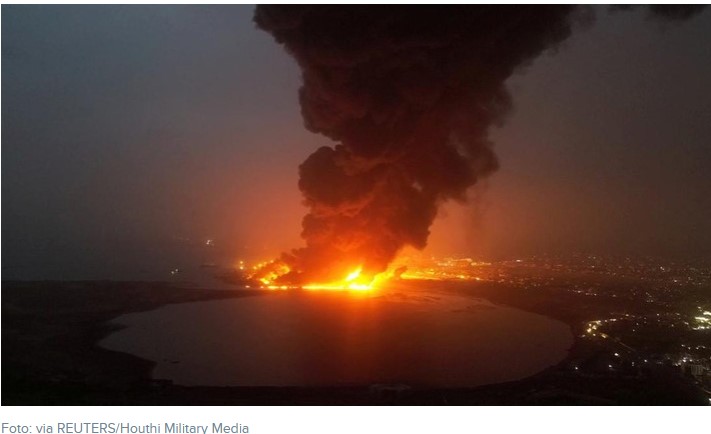

Nonetheless, he expects Indonesia to maintain its trade surplus next year thanks to strong demand for coal, a commodity that has become more competitive against other sources of energy as some developed economies involved in geopolitical conflict eschew Russian oil and gas.

At the closing of the 2022 IMF and World Bank Group Annual Meetings in Washington, D.C. on Saturday, IMF Managing Director Kristalina Georgieva urged 190 member countries to prepare for the impending “severe storm” of the global economic crisis. The IMF deemed that the two years of the COVID-19 pandemic, which was followed by the Russo-Ukrainian War, had a significant impact on global trade activity and financial market turbulence.

Editorial has underlined that global pundits have warned that 2023 global trade and finance market still murky, then every countries are going to be carefull to investment or anything policy related to finance business. Those conditions must be attentioned by the government of Indonesia if they do not want Indonesia’s economic chaotic will happen. The development of an infrastructure new capital city in East Kalimantan and the preparation of simultaneous 2024 general elections (both presidential election and legislative election) are facing seriously problems which are needed to wise overcome.