STRATEGIC ASSESSMENT. Indonesia’s president Joko Widodo has called on the west to release a promised $20bn to finance his country’s green energy transition and do more to support its critical resources, which underpin emerging technologies such as electric vehicles and batteries.

Indonesia’s Just Energy Transition Partnership, the $20 billion fund earmarked for investment in clean energy, took a big step forward in November with the release of the Comprehensive Investment and Policy Plan. One of the requirements under the JETP framework is to prepare a roadmap for how Indonesia will accomplish its energy transition goals (peak emissions in 2030, net zero by 2050).

Coal is still going to play a major role in the near-term. Part of the overall decarbonization strategy is, in theory, to retire coal-fired power plants before the end of their useful economic lives. I have long thought this was a hugely difficult puzzle to solve. These power plants can cost billions of dollars to build and investors expect to recoup their capital over many decades of operation.

It’s essential to remember that Indonesia is a huge country with a population of more than 270 million people and about 64.2 million micro, small and medium enterprises. However, the banking infrastructure is not ideal, and there are many underserved populations. Today, Indonesia has more than 300 fintech-related startups.

Srikandi Lestari Director Mimi Surbakti said the Just Energy Transition Partnership (JETP) Civil Society Dialogue event in Jakarta that the JETP investment plan was deemed to have no effect on regional and coastal communities. People in regional areas, in fact, bear the brunt of the effects of climate change.

She said that the word “just” was not implemented fairly in the Comprehensive Investment and Policy Plan (CIPP) document. She concluded that the document’s lack of inclusion of regional communities made them the target of a central government-mandated policy.

Communities impacted by a multibillion-dollar climate deal to help Indonesia shift from polluting coal power to renewable energy are at risk of losing out because they have had limited involvement in planning the transition so far, analysts warned.

Earlier this month, the government published a plan for how it will slash planet-heating emissions from its power sector under a $20 billion Just Energy Transition Partnership (JETP) backed by wealthy nations, welcomed as a good start by energy experts. But the plan does not address the potential consequences of the proposed emissions-cutting measures for coal workers and local people, said Tommy Pratama, executive director of Traction Energy Asia, an Indonesian policy think-tank.

Indonesia’s early coal retirement program has received paltry funding in the Just Energy Transition Partnership (JETP), which experts say indicates how hard it is to persuade donors and financial heavyweights to back the program. According to the draft investment plan, only around $1.5 billion of the $21.5 billion total pledged for Indonesia’s JETP is designated for the early retirement and managed phaseout of coal-fired power plants in the country.

Andri Prasetiyo, a researcher at Senik Centre Asia, told The Jakarta Post that the small portion of funds allocated for early coal retirement was inseparable from donors’ judgment that the program was commercially unviable.

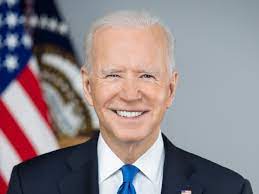

U.S. President Joe Biden reaffirmed his commitment to partner with Indonesia in overcoming the climate crisis. Indonesia and the United States will continue to collaborate closely on the JETP, announced at the 2022 G20 Summit in Bali.

Maritime Affairs and Investment Coordinating Minister Luhut Binsar Pandjaitan revealed that the United States had released funds belonging to PT Pertamina worth $300 million (IDR4.7 trillion) which had previously been stalled in Venezuela.

Amnesty International Indonesia Executive Director Usman Hamid in a political discussion event outlined a number of steps taken by President Jokowi that kicked off democracy, both in politics and the economy. Usman addressed the issue of populism mobilization, which he considers very close to President Jokowi, which is now being built with Kaesang and also with Gibran.

Apart from politics, Usman said that President Jokowi’s influence was also felt in the economic sector. He said there was a change in the economic axis in Indonesia, citing Indonesia in the New Order era was on the axis of U.S. capitalism, while in the Jokowi era, Indonesia was on the axis of Chinese capitalism.

Economic Affairs Coordinating Minister Airlangga Hartarto along with economic ministers from 13 IPEF partner countries signed the Supply Chain Agreement at the Indo-Pacific Economic Framework (IPEF) Ministerial Meeting in San Francisco.

This agreement is based on the strong desire of IPEF partner countries to have a strong and competitive supply chain in the Indo-Pacific region. All member countries of the IPEF also agreed to announce the substantial completion of Pillar III (Clean Economy) and Pillar IV (Fair Economy).

Thus, with the completion of the Pillar II, Pillar III, and Pillar IV agreements, IPEF partner countries are committed to diversifying investment, strengthening supply chains, developing markets, and ensuring a widely distributed economy in the Indo-Pacific region.

The Biden administration has vowed to continue negotiating an ambitious Asia trade deal, but election-year pressures and resistance to tough commitments from some countries make a deal unlikely, trade experts and business groups say.

The Biden administration had emphasized finishing key chapters of its Indo-Pacific Economic Framework (IPEF) initiative trade “pillar” in time for this week’s Asia-Pacific Economic Cooperation (APEC) meeting, aiming to offer the region an alternative to China’s growing trade clout.

That effort failed after some countries, including Vietnam and Indonesia, declined to commit to strong labor and environmental standards with binding enforcement provisions. The lack of trade outcomes overshadowed the Commerce Department’s announcement that it had completed two more non-binding IPEF pillars on clean energy cooperation and anti-corruption measures.

U.S. and Indonesian presidents recognized not just the importance of Indonesia’s nickel sector but also “the United States’ significant critical mineral resources and the Biden Administration’s commitment to developing the full U.S. critical mineral supply chain.”

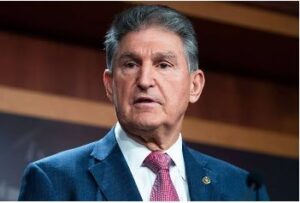

The IRA not only makes tax credits conditional on domestic or FTA partner sourcing but excludes battery inputs derived from a foreign entity of concern (FEOC). The whole point of the linkage, according to its architect Senator Joe Manchin, is to “help end China’s domination of various mineral commodities and supply chains.”

This is a big problem for Indonesia. Chinese companies, led by the pioneering Tsingshan Group, have been the drivers of the country’s ascent to the world’s top nickel producer. And they continue to invest. Benchmark Minerals projects that by 2032 over half Indonesia’s refined nickel output will come from Chinese-owned companies.

A number of U.S. senators asked their government to reconsider importing nickel from Indonesia because the product, which is the main raw material for making batteries for electric vehicles, is considered to have environmental and human rights (HAM) problems.

The senate conveyed this request in letters, sending it to several ministries or departments in the United States, including the Department of Energy, Department of Finance, Department of Trade, and Department of Resources. The letter is also a response to the proposal for ‘limited free trade’ in nickel commodities previously submitted by the Indonesian government.

Corruption Eradication Commission (KPK) investigators have begun investigating criminal indications of the case of “embezzlement” in the export of five million tons of nickel ore to China. Information gathered from law enforcement and government officials reveals that gaps in the nickel trade governance system are considered to be the cause of the “leakage” of Indonesian nickel exports to China since 2020.

In fact, the government has banned the export of nickel ore since 2020. Information gathered by Bisnis explains that Indonesian nickel ore sent to China was “sticking” to iron sand exported by a company in South Kalimantan. This company was once mentioned by Maritime Affairs and Investment Coordinating Minister Luhut Binsar Pandjaitan, after the issue of nickel exports to China emerged.